What is all the hype about CECL?

This article will focus on Simplifying CECL for Banks and Credit Unions.

What does CECL mean? – The Financial Accounting Standards Board (FASB) issued the final Current Expected Credit Loss (CECL) standard on June 16, 2016. After the financial crisis in 2007-2008, the FASB decided to revisit how banks estimate losses in the Allowance for Loan and Lease Losses (ALLL) calculation. Currently, the impairment model is based on actual losses experienced over time for the various portfolios.

For instance, let us say that a bank has experienced an average loss on their Credit Card portfolio over time of 3.5%. In the current scenario, the bank is expected to carry an ALLL reserve for the Credit Card portfolio of 3.5%. The reserve might be 0.50% for Home Equity loans, 1.20% for Construction loans, and so on. If given a good mix in their loan portfolio, the average reserve for all loans will typically be in the range of 1.20% to 1.50%.

This model will be replaced by the new CECL model. When I had my FINRA Series 63 License, I had to be overly cautious when offering advice. I constantly had to tell clients, “Past performance is no guarantee of future performance.” If I was going to recommend a stock, I had to know a lot more about the company such as management philosophy, current investments they are making for improvement, and how their competitors are faring. I needed to know many more factors than just past performance to make a recommendation.

CECL says that you cannot look at past performance of various loan pools to determine your ALLL reserve. You now have to look at each loan individually and take into account many factors to determine the probability of that specific loan going bad. That sounds simple enough if you have just a few loans. The problem is that most banks and credit unions thousands of loans.

Even if the process just took five minutes per quarter to come up with an appropriate reserve calculation for each loan, that would require 167 hours of work for a bank with just 2,000 loans ((2,000 * 5 minutes) / 60 minutes per hour). That is the equivalent of one person spending 55 hours of their time every single month coming up with reserve calculations. When done over a year or two, the total average ALLL reserve will turn out to be the previous long-term average of 1.20% to 1.50%. What a colossal waste of time!

(source)

We need Consultants and Predictive Analytics to help us! – Under the new Current Expected Credit Loss model, financial institutions will be required to use historical information, current conditions and reasonable forecasts to estimate the expected loss over the life of the loan. The transition to the CECL model will bring with it significantly greater data requirements and changes to methodologies to accurately account for expected losses under the new parameters.

Let’s take our 2,000 loan bank example using the average loss ratio of 1.50%. That translates into 30 loans at any one time are going to go bad in that portfolio. What Predictive Analytics does is to look at as many data points as possible for all of your loans over the past five years. Some of the factors will be life of the loan, loan to value, FICO/Credit Scores, times past due, etc.

They will then analyze all the loans that went bad over the past five years to look for common patterns. What is most important about predictive analytics is that it will tell you what those bad loans looked like 12 to 6 months prior to actually going bad. To test the model’s validity, they will score your current portfolio for the next 6 to 12 months to predict which loans will go bad. As history plays out, the consultant building the model will constantly tinker with the predictive factors to make improvements.

Predictive Analytics Today has a web site that analyzes 52 of the top Predictive Analytics and Prescriptive Analytics software solutions that are out in the market today. If you don’t have the staff or resources to purchase and run these solutions, you will be spending money on consultants over the long haul to calculate your ALLL reserve loan by loan. Over the long run that reserve will end up being in the range of 1.20% to 1.50%. What a colossal waste of money!

(source)

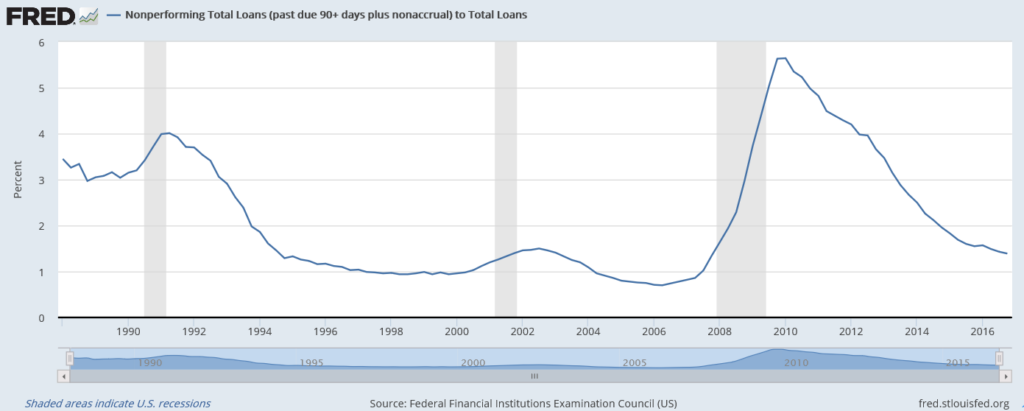

So what does the research say? – According to the Federal Reserve Bank of St. Louis, 90+ day past due plus nonaccrual loans have hovered anywhere from 2% to 3% since 1962. The big exception, of course, was the recent spike from the “Great Recession” up to 5.5%. That has since come down to our long term range. Once a loan falls into this bucket, the odds are very high that it will go bad. Not a lot of science is needed to predict the ALLL reserve for this category of loans.

What about the other 97% of our loan portfolio? After attending the FMS Forum (FMS is a professional membership organization with close to 1,600 professional members from community banks, thrifts, credit unions, and vendor partners, from across the country), meeting with several consultants with expertise in CECL modeling, and reading lots of articles on the subject, my research says that there are two key predictors for the ALLL calculation.

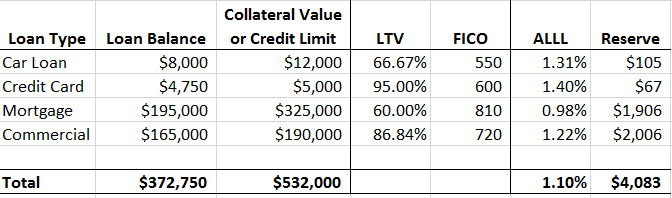

Loan-to-value (LTV) and Credit Score (FICO) are the two factors that have the highest predictive value for almost every CECL model. Loan-to-value is the total amount of the loan outstanding compared to the collateral securing the loan. For instance, if you have a home that is worth $100,000 and the mortgage is $80,000 then your LTV is 80%. For unsecured loans, the LTV proxy is the outstanding loan amount versus the credit limit. The higher the LTV percentage is, the higher the probability is of that loan eventually going bad.

Conversely, the higher an individual’s FICO score is the more likely they will be able to pay off their loans. So as their FICO score decreases, the higher the probability of the loan going bad.

If banks and credit unions do not have a ton of money to invest in Consultants and Predictive Analytics, they should put their resources into keeping their LTV and FICO scores up to date. Having the most accurate and current LTV and FICO scores possible will more than adequately give them enough information on the 97% of their loan portfolio to make accurate ALLL calculations.

Here is a super simplified ALLL formula using LTV and FICO.

ALLL = (LTV * 0.60%) + (5 / FICO)

Examples:

Obviously, work would need to be done to calibrate the LTV and FICO factors for your various loan types to come with more accurate ALLL calculations. But if you have limited funds for Consultants and Predictive Analytics, this would be a great start. What a great way to save a lot of time and money!

By: Daniel Havey, CPA