CECL Clearinghouse

FinServAnalytics launches CECL Clearinghouse, a Regression Analysis approach to CECL.

CECL, or the accounting pronouncement Current Expected Credit Loss of a loan is based on certain characteristics. One of the most common characteristics used for the analysis is the year that the loan was originated. These Vintage or Static Pool approaches assume that all the loans within the pool behave identically.

The main weakness of these approaches is that the loan pools are still performing while you have balances. You have to guess how other factors such as the economy, housing starts, and unemployment rates will affect your loss rates for each of the pools. Another weakness of these models is that they offer very little actionable information. Knowing the loss experience of prior period loans does not give you much direction.

The main challenge is to determine just what factors and how many are needed to do a decent job of coming up with the Current Expected Credit Loss for each loan. There can be countless factors such as interest rate, age of loan, collateral value, days past due, and many others to choose from.

The beauty of using regression analysis for CECL purposes is that it can analyze many data points and return very objective projections. The whole point of regression analysis is that it provides a best fit based on the observed factors. There is no need for subjective guesses on the economy, housing starts, and so forth. Again, the main struggle is to figure out which factors to choose and how to manage the whole regression analysis process.

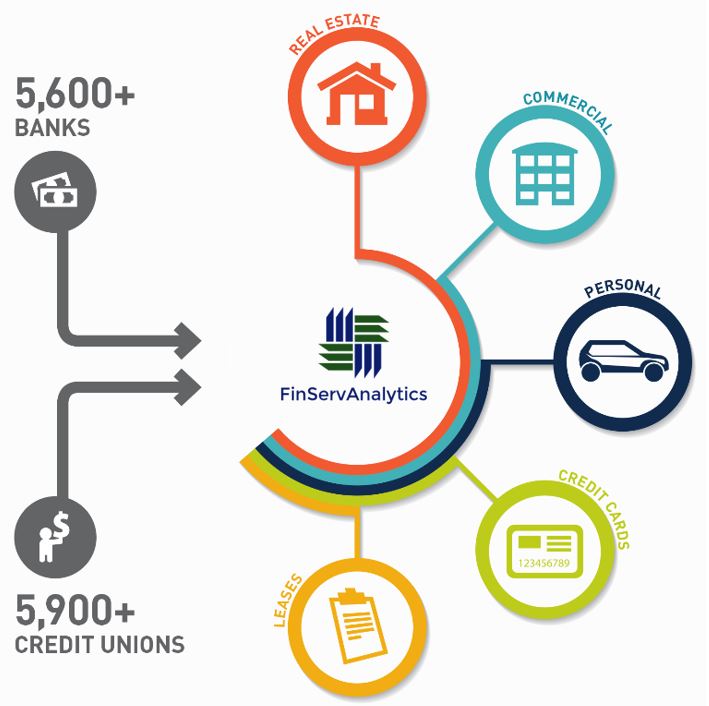

CECL Clearinghouse – If you are looking for a regression model that has already been built off the loan loss experience of multiple banks and credit unions, CECL Clearinghouse would be a good fit. This is a service that is being offered by FinServAnalytics. All your institution needs to do is send a monthly loan file with seven characteristics to FinServAnalytics and they will append the appropriate loan loss reserve to each loan based on the regression model.

Pricing/Implementation

- Annual Subscription

- Loans < $500Mil – $5,156 (1 – 2 days)

- Loans $500Mil to $1Bil – $7,734 (2 to 4 days)

- Loans $1Bil – $2.5Bil – $10,312 (5 days)

- Loans > $2.5Bil – $12,890 (8 days)

- Loans based on most recent Call Report filed with FDIC/NCUA

Key Benefits

- First time analysis is free

- Leverage loan loss experience from multiple banks and credit unions

- Regression analysis approach / most objective

- Calculate a Current Expected Credit Loss for each loan

- Done on an as-needed basis / defaults weekly, monthly, quarterly schedules

- Identify areas of risk in your portfolio quickly

- Catalogue of basic reports come out of the box